The Financialization of Portuguese Real Estate: Why a Price Correction is Unlikely

Recent government announcements of increased funding for affordable housing are based on the conventional wisdom that Portugal's housing crisis is a simple matter of supply and demand. However, a deeper analysis suggests the market has undergone a fundamental and irreversible change. Housing is no longer just a primary necessity but has been fully integrated into global financial markets as a prime investment asset. This financialization explains why the much-discussed property 'bubble' is unlikely to burst, as the market's drivers are no longer tied to local incomes but to international capital flows.

This transformation was significantly accelerated by the monetary policies of the last two decades. Years of near-zero interest rates and quantitative easing by the European Central Bank made traditional savings accounts unattractive, pushing investors towards assets with higher yield potential. Real estate emerged as a preferred choice due to its tangible nature, historical stability, and the availability of cheap credit for leverage. A widespread belief that property values only ever increase, fueled by years of consistent growth, created an investment-driven demand that now far outweighs the demand for primary housing.

This dynamic has created an insurmountable competitive advantage for capital-rich investors over typical families. While an average Portuguese household must save for years to afford a down payment, an investment fund can acquire numerous properties at once, leveraging them to generate immediate rental income and reinvesting the profits to expand their portfolio. This self-perpetuating cycle concentrates wealth and property ownership, driving prices further away from what local salaries can support. The data from the past decade is devastating: house prices in Portugal have more than doubled, while wage growth has been marginal at best.

The most compelling evidence of the market's disconnect from the local economy was its performance during the Covid-19 pandemic. Against all expectations of a slowdown, property prices continued to climb. This paradox demonstrates that the Portuguese housing market now operates in response to global investment strategies and capital flows, not the financial health of its residents. A property in Lisbon is now valued based on its competitiveness in a global investor's portfolio, measured against assets in other international cities, rather than on local affordability.

Need Expert Guidance?

Get personalized insights from verified real estate professionals, lawyers, architects, and more.

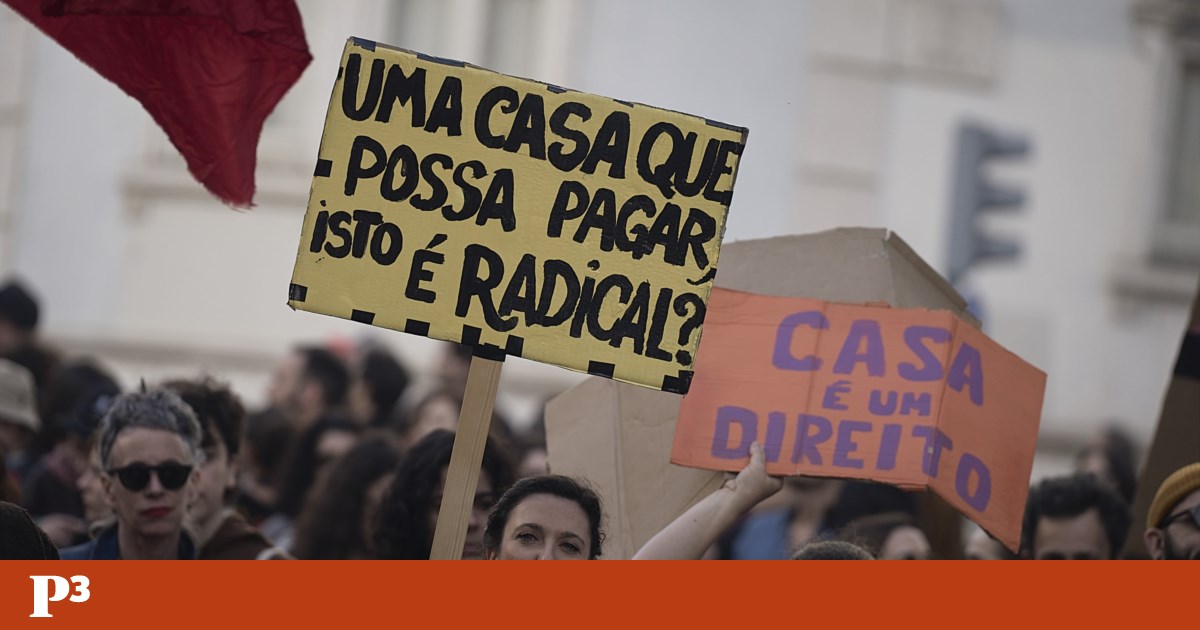

Consequently, the government's strategy of simply increasing housing supply is unlikely to resolve the affordability crisis. Such a policy risks feeding more inventory to the very international investors who are driving up prices. A sustainable solution would require bold structural policies aimed at decoupling the housing market from speculative financial forces. Proposed measures include implementing progressive taxes on non-primary residences, enforcing meaningful restrictions on foreign non-resident investment, tightly regulating real estate investment funds, and launching a large-scale, state-controlled public housing program.

The notion that property prices will naturally correct or 'normalize' is a misunderstanding of the current market structure. The integration of housing into the global financial system is not a temporary speculative bubble but a permanent new reality. Just as one would not expect the New York Stock Exchange to simply disappear, it is unrealistic to expect housing prices to return to historical affordability levels without decisive political intervention to counter decades of rampant financialization.

Stay informed on Lisbon property market developments at realestate-lisbon.com.