Student Rents in Lisbon and Porto Climb 9% as Supply Crisis Deepens

A new market analysis has announced that students seeking accommodation in Lisbon and Porto for the new academic year will face average rent increases of 9% for private rooms. The report, published by the real estate consultancy Cushman & Wakefield, confirms the continuation of a sharp upward trend in rental prices, following an average increase of over 11% that has been accumulating since 2022. This sustained price inflation is placing significant financial pressure on the student population in Portugal's two largest cities.

The detailed breakdown of price movements shows a clear divergence between the public and private sectors. In privately managed, purpose-built student accommodation (PBSA), the monthly cost for a studio now oscillates between €650 and €1,500. In contrast, the prices in public university residences are considerably lower, with single rooms ranging from €253 to €413. However, the report highlights that the overwhelming majority of new supply is coming from private developers, and this high-end stock is unaffordable for a large segment of the student population, particularly the nearly 45,000 students who are displaced and rely on social support.

Several factors are contributing to these persistent price changes. The primary driver is a fundamental and severe shortage of housing across all sectors in Lisbon and Porto. This general housing crisis has pushed non-student populations, including young professionals and families unable to buy homes, into the traditional shared apartment market. This increased competition for a limited pool of rental properties has a direct inflationary effect on rooms and small apartments that were once the domain of students. The report from Cushman & Wakefield explicitly states that this spillover from the broader housing market is the main cause of the rent hikes.

Real estate agency reports and market observations confirm these findings. Data from several online rental platforms show a decrease in the number of available room listings compared to the previous year, coupled with a significant increase in the average asking price per room. Market observers note that properties are being rented within days, and often hours, of being listed, indicating a level of demand that far outstrips the available supply. This frenetic market activity gives landlords considerable leverage to increase prices annually.

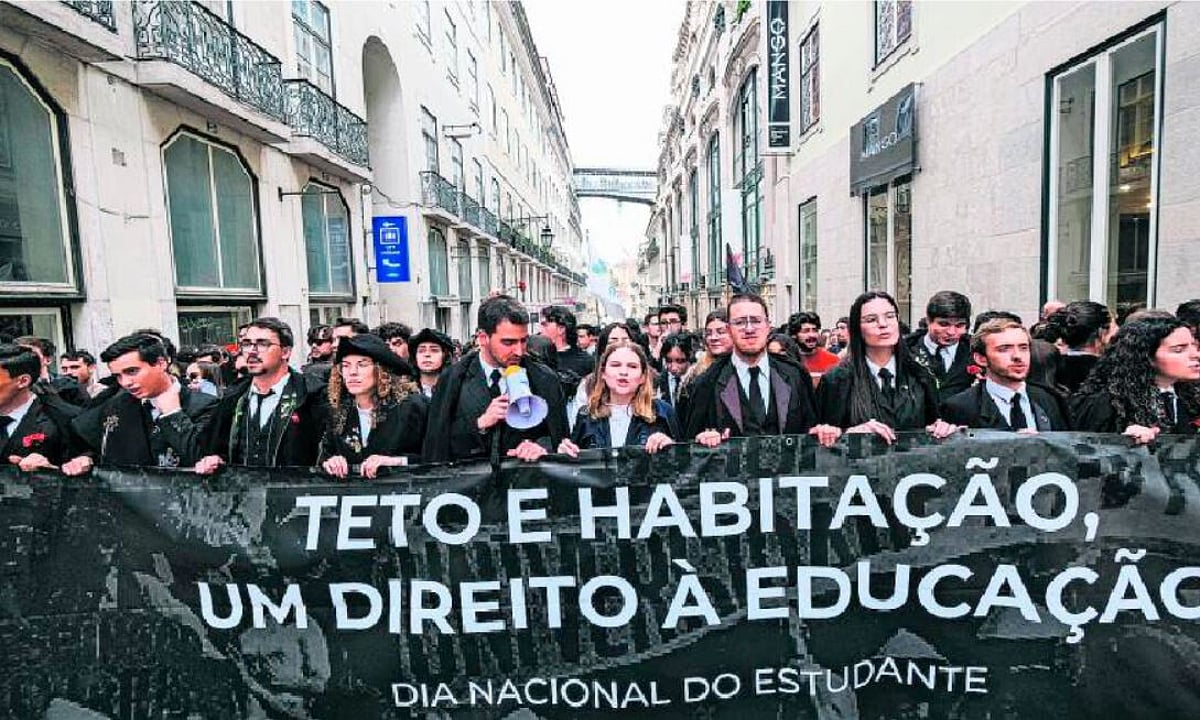

The behavior of both buyers and sellers—or in this case, renters and landlords—reflects the market tension. Students are forced to begin their search for accommodation months in advance and often have to accept sub-optimal living conditions or locations due to a lack of choice. Landlords, aware of the high demand, are less inclined to negotiate on price and are often requiring larger deposits and more stringent financial guarantees than in previous years. This creates a highly challenging environment for young people, especially those from lower-income backgrounds or from abroad.

The mortgage market and lending conditions, while not directly impacting most student renters, play an indirect role. As higher interest rates and strict lending criteria make homeownership more difficult for the general population, more people remain in the rental market for longer. This systemic issue, as noted by economists, adds to the long-term rental demand and prevents a natural easing of prices. The student rental market is therefore not operating in a vacuum but is instead at the sharp end of a much larger, national housing problem.

Need Expert Guidance?

Get personalized insights from verified real estate professionals, lawyers, architects, and more.

A comparison with neighboring regions or similar university cities in Europe reveals the severity of Lisbon and Porto's situation. While student accommodation costs are rising across Europe, the rate of increase in Portugal's main cities is among the highest. The ratio of available student beds to the total student population in Lisbon and Porto remains below 10%, which is significantly lower than the European average of 12% and well below the 15-20% seen in more mature student housing markets like Germany or the Netherlands.

Property developers have reacted to the market pricing trends by focusing on high-end PBSA projects, which offer higher returns on investment. However, the report by Cushman & Wakefield points out that the development pipeline is constrained. Complex and slow municipal licensing processes, a scarcity of available land suitable for development in central urban areas, and rising construction costs are all significant barriers to bringing new supply to the market quickly. This ensures that the supply-demand imbalance is likely to persist.

Local government response and policy considerations have so far been insufficient to resolve the issue. While the national government has a National Plan for Higher Education Accommodation (PNAES), the report notes that many of the announced public projects have been suspended or delayed. The plan aims to create over 14,000 new beds in public residences, but the execution has been slow. This leaves the market heavily reliant on private sector solutions that do not cater to the most financially vulnerable students.

The market timing for current transactions is critical for students. Those who delay their search until late August or early September will find almost no availability and will face the highest prices. This has led to a shift in the rental cycle, with the peak search period now starting as early as June. This has implications for students who do not receive their university acceptance letters until later in the summer, placing them at a distinct disadvantage.

Based on current indicators, the expected price trajectory for student accommodation in Lisbon and Porto is likely to continue upwards. Without a significant and rapid increase in the supply of affordable housing options, both public and private, the market fundamentals point towards further rent inflation in the coming academic years. Cushman & Wakefield concludes that the disequilibrium between supply and demand will continue to worsen, aggravating the cost of accommodation for the foreseeable future. Stay informed on Lisbon property market developments at realestate-lisbon.com.