Invest Today in Amadora: Find High-Yield Properties on Lisbon's Edge

By Mihail Talev

Published: September 9, 2025

Category: Investment & Strategy Guides

By Mihail Talev

Published: September 9, 2025

Category: Investment & Strategy Guides

For savvy investors looking beyond the saturated city center, Amadora is emerging as a strategic hub for capital growth and strong rental returns. The time to buy is now.

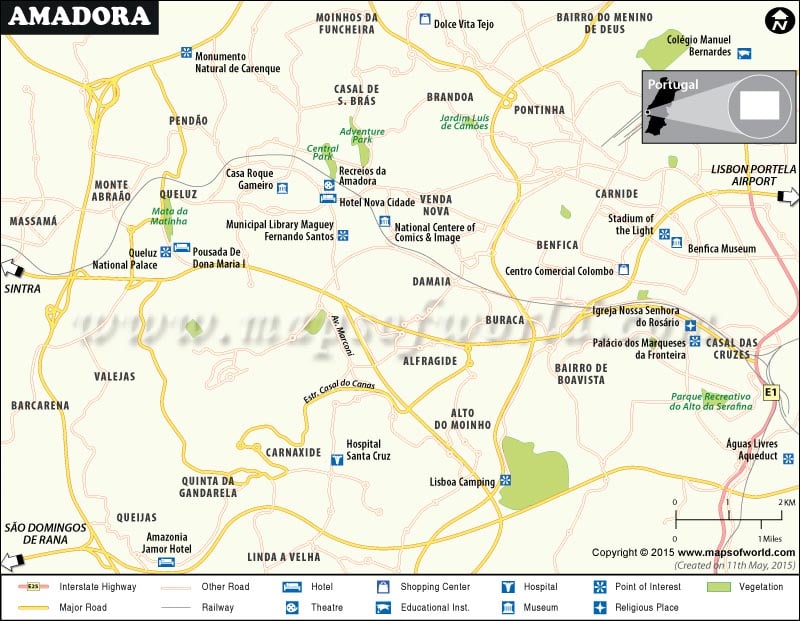

The secret to successful property investment often lies in identifying growth before it becomes obvious. While all eyes are on central Lisbon, the adjacent municipality of Amadora is quietly transforming into an investment hotspot. A clear signal of this shift was reported by NiT on September 3, 2025: the imminent opening of the €63 million Moxy Alfragide Lisboa hotel. This major investment by an international brand like Marriott is a massive vote of confidence in the area's economic future and a catalyst for further development.

This commercial growth is happening against a backdrop of a nationwide rental crisis. As reported by Executive Digest on September 3, 2025, rental prices in Portugal rose 3.3% annually, with Lisbon hitting a staggering €22.2/m². This makes affordable, well-connected suburbs like Amadora more attractive than ever for renters, creating a golden opportunity for buy-to-let investors. Our team of investment property specialists can help you capitalize on this trend.

Amadora's investment thesis is built on a powerful combination of affordability, connectivity, and growth potential. Unlike the prime Lisbon districts where prices may be peaking, Amadora offers a significantly lower entry point. This allows investors to acquire properties with a higher potential for capital appreciation as the area continues to develop.

Furthermore, its strategic location at the 'gates of Lisbon,' as described by the Moxy hotel's management, is a key asset. With excellent train, metro, and bus links, residents can reach the capital's center quickly and affordably. This ensures a deep and consistent pool of potential tenants, from young professionals to families seeking more space for their money. For more analysis on up-and-coming areas, visit our neighborhood news section or external sources like Portugal's National Statistics Institute (INE).

Don't wait for the market to mature. The best returns are made by those who invest early. Let us know your investment goals, and we'll provide a tailored portfolio of high-yield opportunities currently available in Amadora.

The opportunities in Amadora are available now and cater to a range of investment strategies. From turnkey apartments to properties requiring renovation, the potential for value creation is immense.

With major investments pouring in and rental demand soaring, Amadora's property market is poised for significant growth. Contact us to secure your investment in this emerging Lisbon hub. Our legal partners can ensure a secure and efficient transaction.

Amadora is undergoing a significant transformation, driven by major private investments and its strategic location. The opening of the new €63 million Moxy hotel in Alfragide, reported by NiT on September 3, 2025, signals strong commercial confidence. This, combined with more accessible property prices compared to central Lisbon, creates a prime opportunity for capital growth and high rental yields.

While specific returns vary, the fundamentals are strong. National rental prices rose 3.3% annually in August, as per data from Idealista on September 3, 2025. Amadora benefits from this trend while having a lower entry price, suggesting higher potential rental yields compared to the saturated central Lisbon market. Our investment property agents can provide a detailed yield analysis for specific properties.

Yes, Amadora boasts excellent connectivity. It has direct train and metro links to central Lisbon, as well as a comprehensive bus network and easy access to major highways. This makes it a convenient and affordable choice for commuters and families working in the capital, ensuring consistent rental demand.

Amadora offers a diverse range of properties, from traditional apartments in established neighborhoods like Venteira and Reboleira to modern flats in new developments, particularly in areas like Alfragide. This variety caters to different investment strategies, whether you're looking for a turnkey rental or a property to renovate and add value.

The target audience is broad, including young professionals, students, and families who are priced out of central Lisbon but still require easy access to the city. The presence of major business parks in Alfragide also attracts corporate tenants. This diverse demand provides a stable and resilient rental market.

Yes, besides private developments like the Moxy hotel, the entire Lisbon Metropolitan Area is benefiting from ongoing infrastructure upgrades. While not in Amadora itself, the future Montijo airport will have a ripple effect on property values across the south bank and adjacent municipalities, increasing the region's overall attractiveness. Stay updated on our investment insights page.

Amadora offers one of the best value propositions. Compared to more established suburbs like Cascais or Oeiras, the entry price is significantly lower, while rental demand remains high due to its proximity and transport links to Lisbon. This combination presents a higher potential for near-term appreciation and rental yield.

The best first step is a strategic consultation to align your investment goals with available opportunities. Our team specializes in identifying high-potential properties in emerging markets like Amadora. Share your investment profile with us to receive a curated list of properties that match your criteria.

Step 1: Contact Information

After contact info, you'll specify your property preferences

Real Estate Expert

Technology leader who architected Real Estate Lisbon's comprehensive platform, transforming how international clients discover and acquire Portuguese properties. Mihail's innovative solutions have streamlined over 800 property searches and reduced average transaction time by 30%.

Get personalized property recommendations based on your specific requirements and preferences.

Click any button to open the AI tool with a pre-filled prompt to summarize this article

Continue exploring insights about real estate in Lisbon and Portugal

Oeiras delivers 5.5% rental yields with €4,185/m² prices—46% below central Lisbon. Home to 150+ tech companies at Taguspark and accessible AL licenses. Your complete 2026 investment guide.

Portugal's housing prices surged 17.2% in 2025—the highest in the EU. With new construction reforms and a €2.8B housing program, here's your complete 2026 buying guide.

Essential criteria for selecting a buyer's agent for Cascais luxury property. Get insights on off-market access, due diligence, and navigating the local market.