Portugal to Impose Development Freeze Around New Lisbon Airport Site

By Pieter Paul Castelein

Published: November 11, 2025

Category: politics

By Pieter Paul Castelein

Published: November 11, 2025

Category: politics

Stay informed with the latest updates and insights in politics

The Portuguese government will implement preventive measures to control urban development across a 25-kilometer radius surrounding the new Lisbon Airport site at Campo de Tiro de Alcochete, located 25 kilometers northeast of central Lisbon along the Tagus River. This development freeze, outlined in the Ministry of Infrastructure's explanatory note to the 2026 State Budget, aims to prevent land use changes that could compromise or increase costs for the €8.5 billion infrastructure project scheduled for completion in 2037.

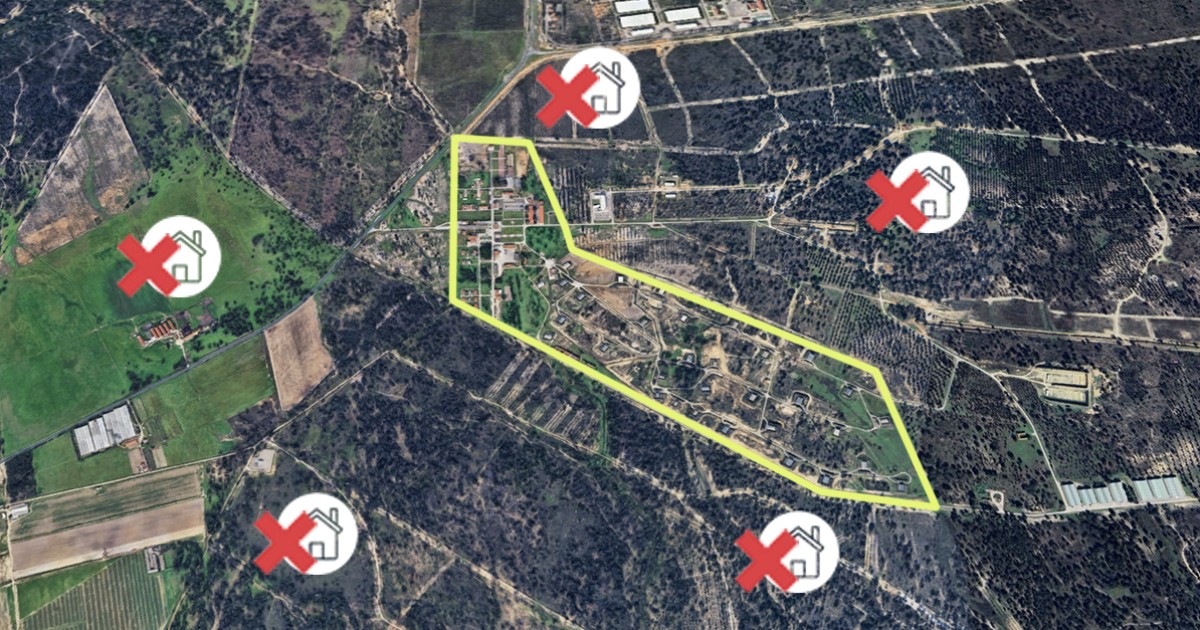

The decision follows similar 2008 restrictions when the Alcochete site was first selected for Lisbon's new airport, demonstrating the government's commitment to protecting this strategic infrastructure investment. ANA Aeroportos de Portugal, the state-owned airport management company overseeing the project, estimates the Luís de Camões Airport will occupy 2,500 hectares and handle 45 million passengers annually, positioning it as one of Europe's major aviation hubs.

The affected area encompasses several strategically important municipalities including Alcochete, a riverside town 25 kilometers northeast of Lisbon known for its natural beauty and proximity to the Vasco da Gama Bridge; Benavente, an agricultural municipality 40 kilometers northeast of Lisbon in the Ribatejo region; Montijo, a growing city 20 kilometers southeast of Lisbon connected by the 25 de Abril Bridge; and Palmela, a historic town 40 kilometers south of Lisbon within the Setúbal Peninsula wine region. These areas, traditionally characterized by rural landscapes and agricultural activities, now face unprecedented infrastructure-driven transformation that will reshape their real estate markets over the next decade.

For foreign investors, this geographic positioning offers unique advantages: the airport location provides direct access to Lisbon via the A1 motorway and future metro connections, while maintaining lower land costs than urban alternatives. The region's combination of natural assets, including the Tagus estuary and protected wetlands, alongside major infrastructure investment, creates compelling long-term value propositions for strategic land acquisition and development planning.

The development freeze creates a complex investment landscape with both immediate restrictions and long-term opportunities. Property owners within the 25-kilometer radius face limitations on subdivision, construction, and new industrial or commercial activities, potentially depressing current land values while creating future scarcity premiums once restrictions lift in 2037.

This strategic intervention demonstrates Portugal's infrastructure planning sophistication and commitment to protecting major investments from speculative pressures. For investors analyzing Portuguese real estate market dynamics, the airport project represents a government-backed catalyst for regional transformation comparable to major European infrastructure initiatives.

The potential for expropriation, while creating uncertainty for current landowners, establishes clear parameters for compensation and development rights that sophisticated investors can navigate. Understanding these regulatory frameworks becomes crucial for assessing risk-adjusted returns in affected municipalities, particularly given the airport's projected capacity to generate significant economic activity and employment.

Foreign investors should recognize that infrastructure projects of this magnitude typically create ripple effects extending beyond immediate construction zones, influencing property values in connected transportation corridors and supporting service areas throughout the Lisbon metropolitan region.

ANA Aeroportos de Portugal, the state-owned company managing Portugal's airports including Lisbon's Humberto Delgado Airport, operates under concession from the Portuguese government and has established itself as a key driver of national infrastructure development. The company's €8.5 billion private financing model for the new airport, eliminating public subsidy requirements, demonstrates confidence in projected passenger demand and commercial viability.

Get personalized insights from verified real estate professionals, lawyers, architects, and more.

The selection of Alcochete over alternative sites reflects ANA's strategic assessment of long-term aviation needs, environmental considerations, and integration with existing transportation networks. The company's track record in managing Portugal's airport infrastructure, including successful expansions at Porto and Faro airports, provides credibility for investors evaluating the project's execution timeline and economic impact projections.

The development freeze affects municipalities with distinct characteristics and investment profiles. Alcochete, with its riverside location and existing residential communities, offers premium positioning for future hospitality and service sector development. Benavente's agricultural heritage and larger land parcels provide opportunities for logistics and industrial planning once restrictions ease.

Several factors will influence investment dynamics around the new airport site:

These interconnected factors create a complex but navigable investment environment for investors with appropriate local expertise and long-term perspective. The scale of infrastructure investment, combined with Portugal's stable regulatory environment, positions the region for sustained growth once operational restrictions are lifted.

Foreign investors evaluating opportunities around the new Lisbon Airport site should adopt strategic approaches acknowledging both restrictions and future potential. Land banking strategies in designated development zones offer potential for significant appreciation once construction restrictions lift, while agricultural or tourism uses may provide interim returns within regulatory parameters.

Investors must navigate Portuguese property law regarding expropriation rights, compensation mechanisms, and development approval processes. Consulting with English-speaking real estate lawyers experienced in infrastructure-related property matters becomes essential for understanding specific rights and obligations within restricted zones.

The extended timeline until 2037 creates opportunities for patient capital to position strategically ahead of operational launch, while shorter-term investors might focus on adjacent municipalities outside restriction zones that will benefit from increased regional activity and improved transportation connections.

The Lisbon airport development represents a transformational infrastructure investment that will reshape regional real estate markets over the next decade. While current restrictions limit immediate development opportunities, the project's scale and government commitment signal long-term confidence in Portugal's economic trajectory and its position as a key European logistics and tourism hub.

For investors with appropriate time horizons and risk profiles, the affected municipalities offer compelling opportunities to participate in one of Europe's most significant infrastructure developments. The combination of government backing, private investment commitment, and strategic geographic positioning creates a foundation for sustained regional growth. For expert guidance on strategic land investment around major infrastructure projects, contact realestate-lisbon.com.

Click any button to open the AI tool with a pre-filled prompt to analyze and summarize this news article