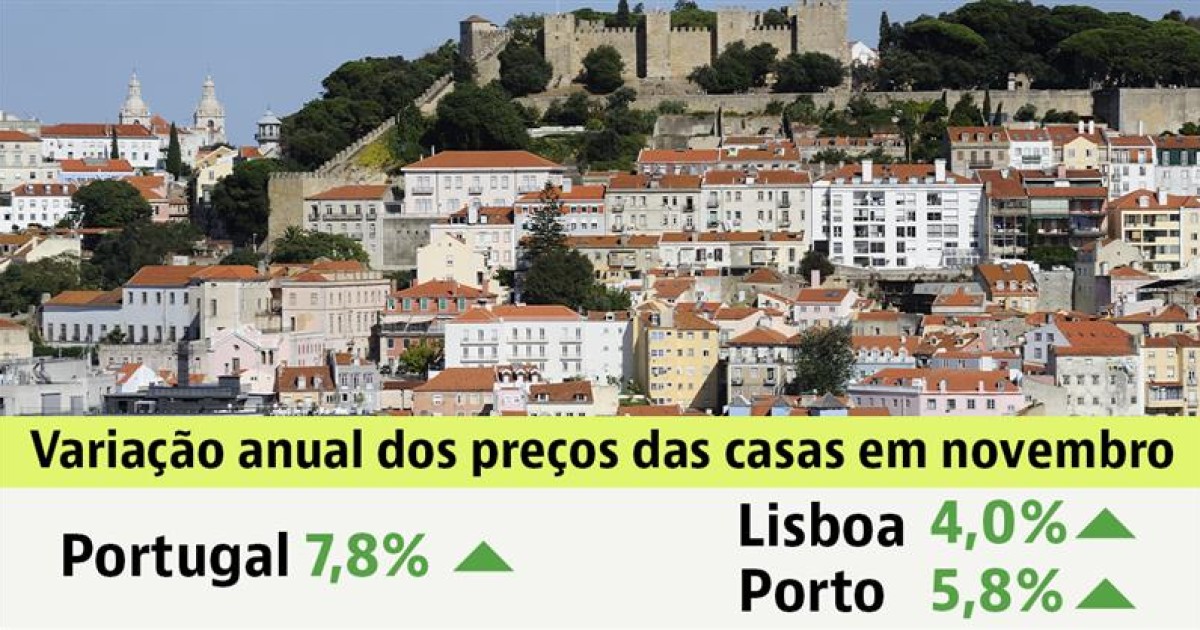

Portugal's Housing Prices Hit Record High with 7.8% Annual Increase, Lisbon Leads as Most Expensive

By Pieter Paul Castelein

Published: December 2, 2025

Category: market-trends

By Pieter Paul Castelein

Published: December 2, 2025

Category: market-trends

Stay informed with the latest updates and insights in market trends

Portugal's residential property market has achieved a historic milestone, with national housing prices surging 7.8% year-over-year to reach €3,000 per square meter in November 2024. This dramatic appreciation, driven by persistent supply-demand imbalances, positions Portugal among Europe's fastest-growing property markets and signals significant implications for international investors seeking exposure to Iberian real estate.

The acceleration reflects broader economic dynamics affecting Portugal's property sector. With housing costs rising across all but one of Portugal's 18 district capitals, the market demonstrates remarkable resilience despite broader European economic uncertainties. For foreign investors evaluating Portuguese real estate opportunities, these price movements underscore both the market's potential and the critical importance of strategic location selection.

Lisbon continues to command premium valuations, with average prices reaching €5,914 per square meter, approaching the psychologically significant €6,000 threshold that typically signals ultra-prime market status. This pricing places the Portuguese capital among Europe's most expensive secondary markets, trailing only major global cities like London, Paris, and Zurich in per-square-meter costs.

The Lisbon Metropolitan Area, encompassing the capital and surrounding municipalities including Amadora, Odivelas, and Oeiras, continues to dominate Portugal's property landscape with average prices of €4,180 per square meter. This region, served by four Metro lines and extensive commuter rail networks connecting to Cascais and Sintra, attracts international buyers seeking proximity to Portugal's economic center while maintaining access to coastal lifestyle amenities.

Secondary cities demonstrate varying performance patterns, with Porto maintaining its position as Portugal's second-most expensive market at €3,908 per square meter. Located 300 kilometers north of Lisbon along the Atlantic coast, Portugal's second-largest city benefits from strong international connections through Francisco Sá Carneiro Airport and growing tech sector employment, supporting sustained housing demand.

The Algarve region, Portugal's southern coastal destination popular with Northern European retirees and holiday homeowners, recorded average prices of €3,862 per square meter. Stretching from Sagres to Vila Real de Santo António, the region's property market benefits from year-round tourism, established expatriate communities, and direct flights to major European cities, creating resilient demand fundamentals for foreign investors.

The nationwide price surge carries profound implications for different investor profiles. For capital appreciation-focused buyers, Portugal's sustained growth trajectory suggests continued upward pressure on valuations, particularly in supply-constrained markets like Lisbon and Porto. However, the 7.8% annual increase also raises questions about market sustainability and potential correction risks.

Rental yield investors face a more complex calculation. While property values escalate, rental growth has not maintained equivalent pace across all markets, creating potential yield compression. According to recent market analysis, prime Lisbon locations now trade at gross yields between 3-4%, comparable to other mature European markets but requiring significant capital outlay for entry.

The geographic distribution of price growth reveals important market dynamics. Interior regions like Alentejo and Centro demonstrated the strongest appreciation rates at 16.9% and 12.1% respectively, suggesting potential value opportunities outside traditional investment hotspots. These regions, characterized by lower baseline prices and growing tourism infrastructure, may offer superior growth potential for investors with appropriate risk tolerance.

Foreign buyers should note that Portugal's property boom occurs alongside evolving regulatory frameworks. The Golden Visa program, while modified to exclude high-density urban purchases, continues to offer residency pathways for investors meeting specific criteria. Understanding these regulatory nuances becomes crucial for maximizing investment structure and minimizing tax exposure.

Portugal's property market exhibits significant regional variation, with distinct characteristics shaping investment opportunities across different geographies. The Azores archipelago, located 1,500 kilometers west of mainland Portugal, recorded the strongest price appreciation at 22% annually, though from a lower absolute base. This autonomous region's unique positioning as a transatlantic hub and growing eco-tourism destination creates niche opportunities for specialized investors.

The Madeira archipelago, comprising Madeira Island and Porto Santo, demonstrated 14.5% annual growth while maintaining premium pricing. Madeira's capital, Funchal, ranks as Portugal's third-most expensive city at €3,864 per square meter, benefiting from established tourism infrastructure, favorable tax regimes, and direct connections to major European cities.

Get personalized insights from verified real estate professionals, lawyers, architects, and more.

Mainland regional performance varies significantly. The Norte region, anchored by Porto but extending to include Braga, Guimarães, and Viana do Castelo, showed more modest 3.7% growth. This moderation may reflect market maturation following several years of strong appreciation, potentially creating stabilization opportunities for value-focused investors.

Portugal's housing market operates within broader European economic dynamics while maintaining unique local characteristics. The country's population of 10.3 million faces housing supply constraints exacerbated by construction industry limitations, regulatory approval processes, and geographic restrictions on development in coastal areas.

Several structural factors continue driving Portugal's property appreciation:

These factors interact to create a market environment where price appreciation becomes self-reinforcing, as rising values attract additional international capital while simultaneously pricing out local buyers. For investors, understanding these dynamics proves essential for timing entry and exit strategies effectively.

The role of institutional investors and foreign capital has grown significantly, with international buyers now representing approximately 20% of transactions in prime markets. This internationalization provides market liquidity but also increases correlation with global economic conditions and currency fluctuations affecting buyer purchasing power.

For foreign investors evaluating Portuguese property opportunities, current market conditions require careful strategic positioning. The 7.8% national appreciation rate suggests momentum-driven market dynamics where entry timing becomes crucial for optimizing returns. Investors should consider detailed investment analysis incorporating local market knowledge and regulatory requirements.

Financing considerations merit particular attention, as Portuguese banks maintain specific requirements for non-resident buyers. Foreign investors typically face higher deposit requirements and may encounter different lending criteria compared to domestic purchasers. Consulting with English-speaking tax advisors familiar with cross-border investment structures can optimize financing arrangements and minimize tax exposure.

Market selection within Portugal requires balancing growth potential against absolute pricing. While Lisbon and Porto offer established markets with proven liquidity, secondary cities like Braga, Aveiro, or Coimbra may provide superior value propositions for investors willing to accept different risk-return profiles. These markets often demonstrate stronger yield characteristics while maintaining reasonable appreciation potential.

Legal due diligence assumes heightened importance in Portugal's accelerated market environment. Property registration systems, while generally reliable, require careful verification of title history, planning permissions, and any encumbrances affecting future development potential. Engaging qualified Portuguese property lawyers experienced in international transactions provides essential protection for significant investments.

Portugal's property market appears positioned for continued growth, supported by structural demand factors and limited supply response capabilities. However, investors should monitor several key variables that could influence future performance, including potential interest rate changes affecting financing costs, regulatory modifications to foreign buyer policies, and broader European economic conditions impacting buyer sentiment.

The market's evolution toward higher absolute pricing levels creates both opportunities and challenges. While established investors benefit from appreciation, new entrants face increasingly competitive environments requiring sophisticated market knowledge and strategic execution. For investors seeking exposure to Portuguese real estate, professional guidance becomes essential for navigating complex market dynamics and identifying optimal investment opportunities aligned with individual risk tolerance and return objectives. For expert guidance on Portuguese property investment opportunities, contact realestate-lisbon.com.

Click any button to open the AI tool with a pre-filled prompt to analyze and summarize this news article