Portugal's Housing Market Heats Up: Property Prices Surge by 8.7% in October 2025 Across All Major Cities

By Pieter Paul Castelein

Published: November 3, 2025

Category: market-trends

By Pieter Paul Castelein

Published: November 3, 2025

Category: market-trends

Stay informed with the latest updates and insights in market trends

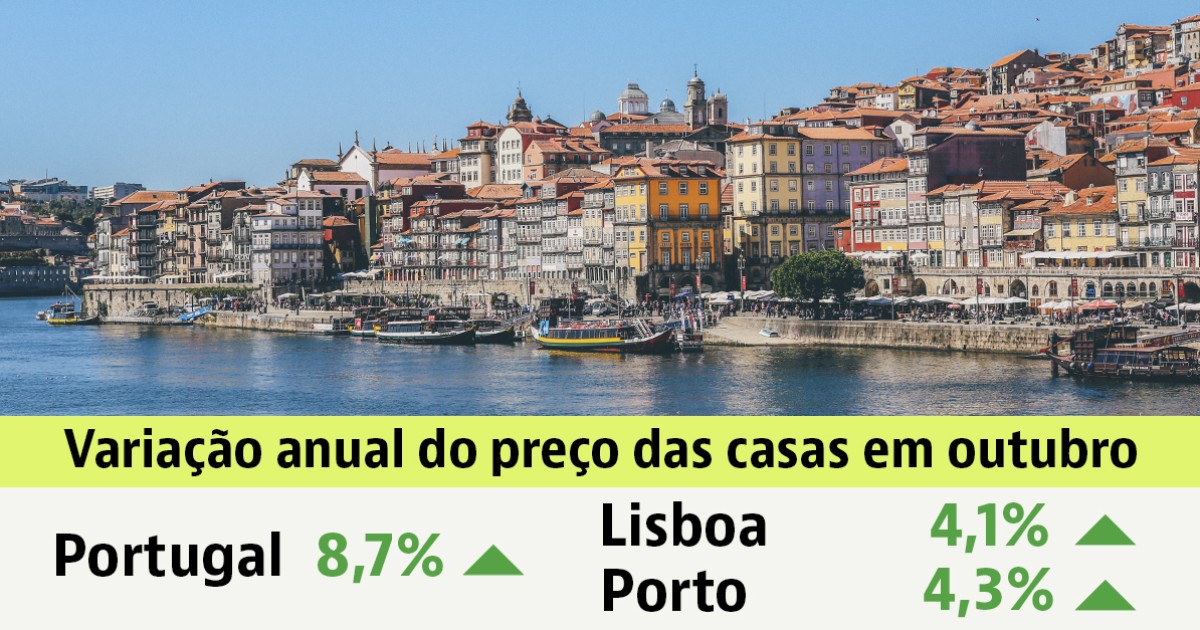

In a notable escalation of Portugal's housing market dynamics, property prices nationwide increased 8.7% year-over-year in October 2025, reaching a median price of €2,970 per square meter. This sustained upward trajectory underscores the persistent imbalance between robust buyer demand and constrained housing supply across the country's residential market.

The price acceleration occurred despite more accessible mortgage financing conditions, creating a paradox for prospective buyers who face improved credit availability but simultaneously encounter rising acquisition costs. Quarterly data reveals a 1.5% price increase over the three-month period, indicating momentum that shows no signs of moderating in the near term.

The nationwide price surge affected all 19 district capitals and autonomous regions analyzed, with secondary cities experiencing the most dramatic appreciation. Beja led all markets with a remarkable 30.6% annual increase, followed by Santarém at 27.8% and Portalegre at 24.1%, signaling significant capital migration toward traditionally more affordable markets.

The geographic distribution of price increases reveals a bifurcated market structure. While Lisbon recorded a comparatively modest 4.1% annual increase and Porto saw 4.3% growth, both cities maintained their positions as Portugal's most expensive markets at €5,886/m² and €3,844/m² respectively. This relative moderation in major metropolitan areas contrasts sharply with double-digit appreciation in smaller regional markets.

Funchal in Madeira secured the second-most expensive position at €3,907/m², reflecting sustained international buyer interest in island properties. The Algarve's Faro maintained its premium coastal positioning at €3,370/m², while Setúbal emerged as a significant market at €2,964/m², benefiting from its proximity to Lisbon and improved transportation connectivity. For detailed neighborhood-level analysis across Portugal's major markets, see our comprehensive regional property guide.

At the district level, only Bragança registered a price correction of -3.2%, making it the sole market to experience depreciation. The most dramatic district-level appreciation occurred in island territories, with Porto Santo surging 29.9%, Terceira Island advancing 21.5%, and São Miguel Island climbing 20.5%, demonstrating intensified investor interest in autonomous region properties.

The divergent price trajectories between established urban centers and emerging secondary markets present distinct strategic considerations for international investors. The pronounced appreciation in previously overlooked cities suggests a maturation of Portugal's residential market, with capital increasingly flowing toward value-oriented opportunities in regions offering superior yield potential relative to acquisition costs.

For foreign buyers, the supply-demand imbalance driving these price increases shows no indication of near-term resolution. Portugal's construction sector continues to face capacity constraints, regulatory hurdles, and labor shortages that limit new housing delivery. This structural deficit supports continued price appreciation across most markets, though at varying rates depending on local market dynamics and development pipeline activity.

The relatively modest price growth in Lisbon and Porto compared to national averages merits careful analysis. These markets may be approaching price ceilings relative to local income levels and rental yield compression, potentially signaling a rotation of investment capital toward higher-growth secondary markets. According to recent market analysis, this trend reflects investor sophistication and willingness to pursue opportunities beyond traditional gateway cities.

Currency considerations remain favorable for many international buyers, particularly those holding stronger currencies relative to the euro. However, the combination of rising property prices and potential interest rate volatility requires careful financial modeling. The availability of more accessible mortgage products provides leverage opportunities but demands thorough assessment of total acquisition costs including transfer taxes, legal fees, and ongoing holding expenses.

The Autonomous Region of the Azores led all regions with a striking 20.8% annual price increase, followed by Alentejo at 18.7% and Madeira at 15.6%. These figures demonstrate a fundamental shift in investor preferences, with buyers increasingly valuing lifestyle considerations, remote work flexibility, and portfolio diversification across multiple Portuguese regions rather than concentrating exclusively in metropolitan areas.

Get personalized insights from verified real estate professionals, lawyers, architects, and more.

The Lisbon Metropolitan Area maintained its position as Portugal's most expensive region at €4,151/m², though its 9.6% annual appreciation lagged behind several other territories. The Algarve sustained premium coastal pricing at €3,849/m² with 9.3% growth, while the Norte region recorded the most moderate increase at 6.5%, suggesting potential value opportunities for investors seeking exposure to Portugal's second-largest metropolitan area around Porto.

Portugal's housing market operates within a complex framework of demographic, economic, and regulatory factors that collectively drive the persistent supply-demand imbalance. The country's appeal to international residents, remote workers, and retirees continues to generate demand that significantly exceeds available inventory, particularly in desirable coastal and urban locations.

Several structural factors continue to influence market dynamics:

The interaction of these factors creates a self-reinforcing cycle where limited supply meets persistent demand, driving prices upward and attracting additional investment capital. This dynamic appears sustainable in the medium term absent significant policy interventions to accelerate housing construction or measures to moderate demand.

The emergence of secondary cities as high-growth markets reflects both affordability constraints in major urban centers and improved infrastructure connectivity that makes previously peripheral locations more accessible. High-speed rail improvements, airport expansions, and digital infrastructure investments have effectively expanded the geographic scope of Portugal's investable residential markets.

Foreign investors evaluating Portuguese residential property should carefully assess the trade-offs between established metropolitan markets offering stability and liquidity versus emerging secondary markets presenting higher growth potential but greater execution risk. The substantial price appreciation in smaller cities like Beja, Santarém, and Portalegre suggests opportunity, but requires thorough due diligence regarding local rental demand, economic fundamentals, and exit liquidity.

Transaction structuring considerations become increasingly important in an appreciating market environment. Buyers should engage qualified professionals to optimize acquisition structures, understand tax implications, and navigate Portugal's property transfer process. International investors should consult with English-speaking real estate lawyers for guidance on cross-border transaction structures, tax treaty implications, and legal due diligence specific to Portuguese property acquisitions.

Timing considerations warrant careful evaluation. While the persistent supply-demand imbalance supports continued appreciation, the magnitude of recent price increases in some secondary markets raises questions about sustainability and potential for near-term corrections. Investors should model multiple scenarios and maintain appropriate risk parameters relative to their overall portfolio objectives and liquidity requirements.

The trajectory of Portugal's residential property market appears poised for continued appreciation in the near to medium term, driven by structural supply constraints that show limited prospects for rapid resolution. However, the geographic dispersion of price growth suggests an evolving market where opportunities increasingly exist beyond traditional gateway cities, requiring more sophisticated market analysis and local expertise.

For international investors, Portugal's residential market continues to offer compelling opportunities within the European context, combining relative affordability compared to other Western European destinations with strong lifestyle appeal and improving economic fundamentals. Successful investment outcomes will increasingly depend on careful market selection, thorough due diligence, and appropriate professional guidance. For expert assistance navigating Portugal's residential property market and identifying opportunities aligned with specific investment objectives, contact realestate-lisbon.com.

Click any button to open the AI tool with a pre-filled prompt to analyze and summarize this news article