Lisbon Rental Prices Ease: What the November Slowdown Means for Buy-to-Let Investors

By Kellogg Fairbank

Published: December 3, 2025

Category: market-trends

By Kellogg Fairbank

Published: December 3, 2025

Category: market-trends

Stay informed with the latest updates and insights in market trends

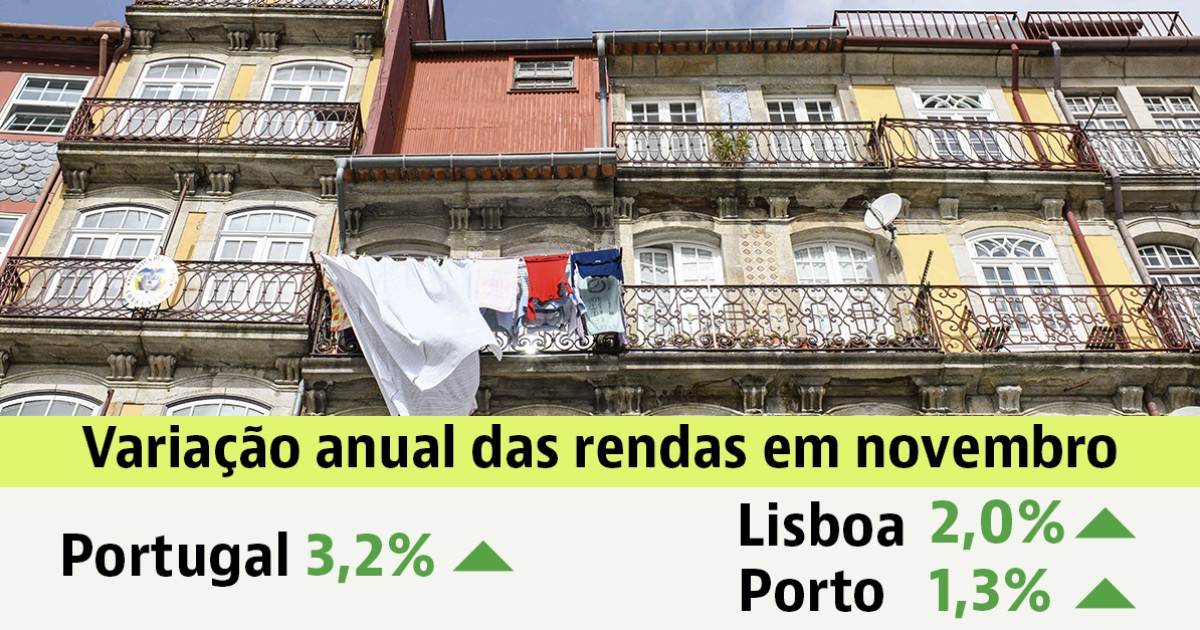

Portugal's rental market demonstrated notable deceleration in November, with annual rent growth moderating to 3.2% from 5.7% the previous month, according to idealista, Portugal's leading property portal. This cooling trend signals a potential inflection point for investors who have witnessed explosive rental growth across Portuguese cities, particularly in Lisbon where rents command €22.4 per square meter, maintaining its position as the country's most expensive rental market.

The moderation in rental price growth reflects increasing supply entering the market, creating new dynamics for buy-to-let investors who have enjoyed unprecedented appreciation in recent years. With median rental costs reaching €16.6 per square meter nationally, the market appears to be finding equilibrium between supply and demand after years of severe housing shortage.

Lisbon, Portugal's capital and economic powerhouse stretching along the Tagus River estuary, encompasses diverse neighborhoods from historic Alfama to modern Parque das Nações. The city's metropolitan area, extending 50 kilometers from Cascais to Setúbal, serves as Portugal's primary business hub and attracts the largest concentration of foreign residents, making it the focal point for international real estate investment. Rents in Lisbon proper reached €22.4 per square meter, nearly 35% above the national median, yet growth has decelerated dramatically to just 2% annually.

This cooling pattern reflects not weakening demand but rather the market's response to increased rental supply through new construction and property conversions. For investors analyzing Lisbon's neighborhood dynamics, understanding these shifting supply-demand fundamentals proves crucial for strategic investment timing and location selection.

The rental market's deceleration carries profound implications for buy-to-let investors who have relied on rapid appreciation for returns. The shift from 5.7% to 3.2% annual growth suggests the market is normalizing after years of exceptional performance, requiring investors to recalibrate yield expectations and investment strategies accordingly.

This market maturation indicates that location selection and property quality will become increasingly critical differentiators. Investors can no longer expect across-the-board appreciation and must instead focus on areas with genuine competitive advantages, such as proximity to transport hubs, universities, or business districts. According to recent market analysis, properties in well-connected areas with modern amenities continue outperforming the broader market.

The data reveals a bifurcated market where prime locations like Lisbon show minimal growth while secondary cities experience continued acceleration. Ponta Delgada's 15.9% rent increase and Viseu's 12.8% growth demonstrate that opportunities persist beyond saturated primary markets, though these come with different risk profiles and liquidity considerations.

Beyond Lisbon's slowing growth, regional rental markets present varied investment landscapes. Porto, Portugal's second-largest city located 300 kilometers north along the Atlantic coast, maintains rents at €17.8 per square meter with modest 1.3% annual growth, suggesting its market has also reached relative maturity.

The Algarve region, stretching along Portugal's southern coastline and anchored by Faro, demonstrates more dynamic growth with 7% annual increases in the capital and 9.3% across the region. This tourism-dependent market offers seasonal rental opportunities but requires careful analysis of occupancy patterns and regulatory compliance for short-term rentals.

Get personalized insights from verified real estate professionals, lawyers, architects, and more.

Portugal's rental market operates within a complex regulatory framework that significantly impacts investor returns. The Novo Regime do Arrendamento Urbano (New Urban Lease Regime) governs most residential tenancies, providing tenant protections that can limit rental increases for existing contracts while allowing market rates for new agreements.

This regulatory environment creates opportunities for investors focusing on new construction or fully renovated properties, as these can command market rates without legacy tenant restrictions. The data showing robust growth in smaller cities partly reflects investors targeting these less-regulated markets where entry costs remain attractive relative to rental yields.

Several factors continue influencing Portugal's rental market dynamics:

For international investors evaluating Portuguese rental properties, the market's cooling suggests a shift from speculative appreciation plays toward cash-flow focused strategies. Properties must demonstrate strong rental yields based on current rents rather than projected appreciation, making thorough due diligence on local rental markets essential.

Foreign buyers should carefully analyze tax implications including potential changes to the NHR tax regime (Non-Habitual Resident), which currently offers favorable treatment for rental income. Consulting with English-speaking accountants familiar with international tax optimization becomes crucial for structuring investments efficiently.

The market's geographic diversification also presents opportunities for investors willing to explore emerging locations. Cities like Coimbra, home to one of Europe's oldest universities, or Braga, with its growing tech sector, offer different tenant profiles and potentially higher yields than saturated Lisbon and Porto markets.

Portugal's rental market appears to be entering a normalization phase after years of exceptional growth driven by housing shortages and foreign investment. While this moderates the rapid appreciation investors have enjoyed, it creates a more sustainable market environment based on fundamental supply-demand dynamics rather than speculative momentum.

For stakeholders in Portuguese real estate, this shift emphasizes the importance of professional property management, strategic location selection, and realistic yield expectations. The market's evolution toward equilibrium doesn't eliminate opportunities but rather requires more sophisticated analysis and local market expertise to identify properties with genuine competitive advantages. For expert guidance on navigating Portugal's evolving rental market, contact realestate-lisbon.com.

Click any button to open the AI tool with a pre-filled prompt to analyze and summarize this news article