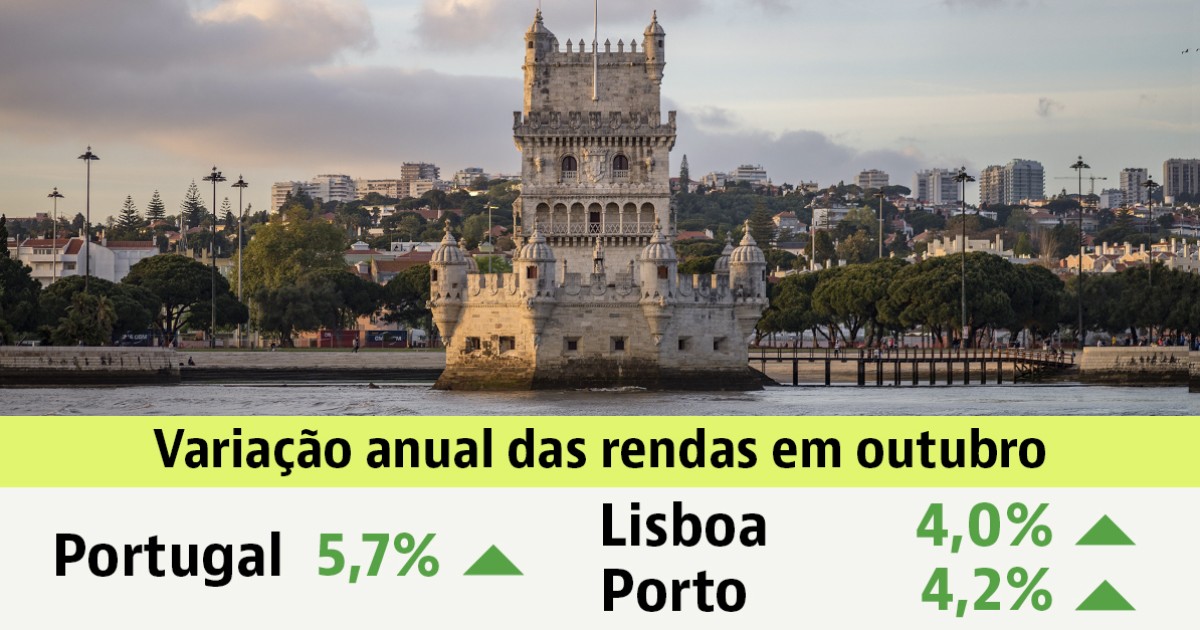

Lisbon Leads Soaring Rental Prices as Portugal Sees 5.7% Annual Increase in October

By Pieter Paul Castelein

Published: November 4, 2025

Category: market-trends

By Pieter Paul Castelein

Published: November 4, 2025

Category: market-trends

Stay informed with the latest updates and insights in market trends

Portugal's residential rental market demonstrated accelerating momentum in October, with national rental prices climbing 5.7% year-over-year, up from 4.1% growth recorded the previous month. This acceleration pushed the country's median rental cost to a record €17 per square meter, according to data from idealista's price index, signaling sustained pressure on housing affordability across the nation.

The nationwide rental increase reflects persistent demand for rental properties, though this demand has become more distributed across an expanding supply base. Despite increased inventory entering the market, rental rates continue their upward trajectory across all Portuguese regions, albeit at varying speeds depending on location and local market dynamics.

For foreign investors and expats evaluating Portugal's residential market, these figures underscore the ongoing strength of rental demand and the potential for income-generating properties, particularly in strategically positioned locations where supply constraints remain evident.

Lisbon continues to command the highest rental rates in Portugal, with prices reaching €22.8 per square meter, reinforcing its position as the country's premier residential market. The capital's pricing reflects its concentration of employment opportunities, international companies, and cultural amenities that attract both Portuguese residents and foreign professionals seeking accommodation in Portugal's economic center.

The Lisbon Metropolitan Area as a whole maintains its status as Portugal's most expensive rental region at €20.2/m², followed by the Algarve at €16/m² and the North region at €14.8/m². This geographic pricing hierarchy demonstrates the premium commanded by areas offering superior infrastructure, employment density, and lifestyle amenities that appeal to Portugal's growing expat community and digital nomad population.

Interestingly, while Lisbon recorded a comparatively modest 4% annual increase, the capital's elevated baseline ensures it remains significantly more expensive than alternatives. For comprehensive analysis of Lisbon's diverse neighborhoods and their respective rental dynamics, see our Lisbon neighborhoods guide.

The divergent growth rates across Portuguese cities present strategic considerations for rental property investors. While Lisbon and Porto recorded single-digit growth rates of 4% and 4.2% respectively, secondary markets demonstrated substantially higher appreciation, with Viana do Castelo leading at 21.9%, followed by Faro at 19.6% and Santarém at 14.8%.

This disparity suggests that secondary cities may offer stronger near-term rental yield growth potential, though investors must balance this against factors such as tenant demand depth, liquidity, and long-term capital appreciation prospects. The accelerated growth in smaller markets often reflects catch-up dynamics as renters seek more affordable alternatives to primary cities, though sustainability of such growth rates warrants careful evaluation.

For income-focused investors, the data reveals that rental demand remains robust across Portugal's entire geographic spectrum. The fact that all analyzed territories recorded price increases without exception indicates fundamental supply-demand imbalances persist nationwide, supporting the investment thesis for residential rental properties across multiple market segments.

The acceleration from 4.1% to 5.7% annual growth between consecutive months represents a significant momentum shift that investors should monitor closely. According to recent market analysis, such acceleration typically reflects either strengthening demand, constrained supply additions, or both factors operating simultaneously in the Portuguese residential sector.

Beyond the headline national figures, Portugal's rental market demonstrates considerable geographic variation that reveals important investment opportunities and risks. District-level analysis shows Beja leading rental growth at 22.1%, followed by Guarda at 21.5% and Castelo Branco at 17.5%, indicating strong momentum in interior regions traditionally considered secondary markets.

Get personalized insights from verified real estate professionals, lawyers, architects, and more.

Several structural factors explain the divergent regional performance across Portugal's rental landscape:

The most economically accessible rental markets remain Viseu at €8/m², Vila Real at €7.5/m², and Castelo Branco at €7.5/m². These interior markets offer entry points for investors seeking lower acquisition costs, though they typically present thinner tenant pools and potentially longer vacancy periods compared to coastal and metropolitan alternatives.

The Algarve region maintains its position as Portugal's second-most expensive rental market at €16/m², reflecting the area's appeal to both seasonal residents and year-round expats attracted by climate, lifestyle amenities, and international connectivity through Faro Airport.

The acceleration of rental growth from 4.1% to 5.7% between consecutive months represents more than statistical noise. This momentum shift reflects underlying market tensions that have important implications for both landlords and prospective tenants navigating Portugal's residential sector.

Portugal's rental market continues to grapple with structural supply deficits that have accumulated over years of underbuilding relative to household formation and immigration. While new construction has increased in recent years, the pipeline of completed rental units remains insufficient to moderate price growth, particularly in high-demand urban markets where land constraints and regulatory complexity limit development velocity.

For international investors evaluating Portugal's rental market, the October data presents both opportunities and considerations requiring careful analysis. The universal price increases across all measured territories demonstrate market-wide rental demand strength, reducing geographic concentration risk for diversified portfolios while also signaling limited options for value-oriented acquisition strategies.

Investors should recognize that Portugal's 5.7% rental growth substantially exceeds inflation rates in many source countries, offering real income growth potential for foreign currency earners. However, this must be balanced against acquisition costs, which have also appreciated significantly in recent years, potentially compressing initial yields even as rental growth prospects remain favorable for well-positioned properties.

The divergence between primary and secondary market growth rates suggests strategic opportunities for investors willing to accept higher execution risk in exchange for stronger rental appreciation potential. Markets recording double-digit growth like Viana do Castelo, Faro, and Coimbra may offer compelling risk-adjusted returns, though investors should conduct thorough due diligence on local employment dynamics, demographic trends, and competitive supply before committing capital to these less liquid markets.

Foreign buyers should consult with English-speaking accountants familiar with Portuguese tax regulations to understand the fiscal implications of rental income, including applicable tax rates, deductible expenses, and reporting requirements that vary based on investor residency status and property holding structure.

Portugal's rental market trajectory suggests continued upward pressure on rates across most geographic segments, supported by persistent demand from both domestic residents and international arrivals seeking accommodation in one of Europe's most attractive lifestyle destinations. The acceleration evident in October data indicates momentum remains firmly positive, with few near-term catalysts likely to materially moderate growth absent significant supply additions or demand deterioration.

For stakeholders in Portugal's residential real estate sector, these dynamics reinforce the fundamental strength of rental property investment thesis while highlighting the importance of strategic location selection and disciplined underwriting. Markets demonstrating sustainable demand drivers, reasonable supply-demand balance, and strong governance frameworks offer the most compelling risk-adjusted opportunities for long-term capital deployment. For expert guidance on navigating Portugal's rental property market and identifying opportunities aligned with your investment objectives, contact realestate-lisbon.com.

Click any button to open the AI tool with a pre-filled prompt to analyze and summarize this news article